Tracking vehicle usage and mileage is essential for accurate tax reporting, especially for businesses or individuals who claim vehicle expenses. Imagine the peace of mind knowing your vehicle expenses are meticulously documented and compliant with tax regulations. Without accurate tracking, you risk costly errors and potential penalties during tax audits. This comprehensive guide will walk you through the crucial steps to effectively track vehicle usage and mileage for tax purposes, empowering you to maximize deductions and minimize potential issues. This article is structured to cover the key aspects of accurate tracking, from choosing the right method to utilizing supporting documentation, and provides practical examples and solutions. We’ll explore detailed logbooks, GPS tracking, and other essential tools to ensure your compliance.

Understanding the Importance of Accurate Vehicle Tracking

Essential for Tax Compliance

Accurate tracking of vehicle usage and mileage is critical for proper tax reporting, ensuring that your deductions are legitimate and compliant with the relevant tax laws and regulations. This meticulous process helps to avoid costly penalties and potential audits, protecting your financial well-being and demonstrating your commitment to transparency. Failure to accurately document vehicle expenses can lead to significant financial repercussions, from hefty penalties to protracted audits. Thorough documentation, therefore, serves as a fundamental safeguard for your financial interests.

Impact on Tax Deductions

Tracking vehicle mileage and usage directly impacts your tax deductions. Accurate records allow you to calculate deductible expenses associated with business travel, transportation, and other relevant activities. By meticulously documenting every trip, you can substantiate your claim for vehicle-related deductions and maximize your tax savings. This detailed record-keeping is crucial for ensuring the legitimacy of your deductions and avoiding any potential disputes with the tax authorities.

Example Scenario

A freelance photographer, for example, who utilizes their vehicle for client appointments and studio transportation, must diligently track their mileage. If they don’t precisely document each trip, they risk underreporting their vehicle usage and missing out on legitimate tax deductions, ultimately diminishing their overall tax savings.

Related Post : Dealing with Unexpected Auto Repairs Costing Your Company Money.

Choosing the Right Tracking Method

Logbooks: The Traditional Approach

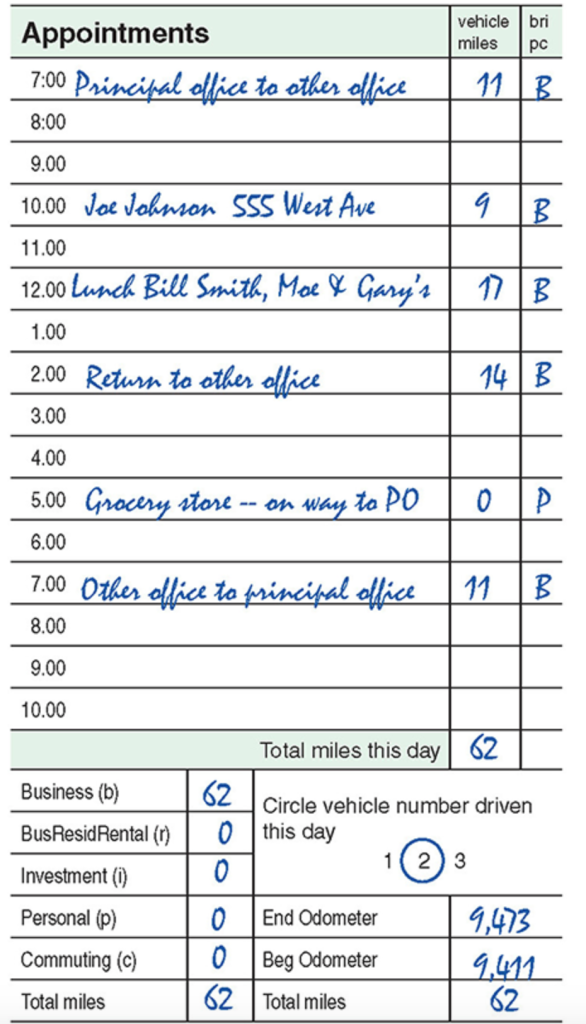

Traditional logbooks remain a reliable method for tracking vehicle usage and mileage. They offer a structured approach, requiring drivers to meticulously record each trip, including dates, times, destinations, and purposes. The simplicity of a well-maintained logbook ensures accuracy, and for many, this straightforward method is preferred due to its ease of use. Many customizable logbook templates are readily available online or from tax professionals.

GPS Tracking Devices and Software: Modern Solutions

GPS tracking devices and software offer a more advanced alternative for detailed vehicle usage and mileage tracking. These technologies offer real-time data capture, providing comprehensive information about vehicle location, speed, and duration of trips. They create detailed records of routes taken and hours spent, eliminating potential human error and inaccuracies. This level of detail can prove invaluable during tax audits, providing irrefutable evidence of vehicle usage and expenditure.

Example Scenario

A small trucking company employing multiple drivers could benefit immensely from GPS tracking. The real-time data provided by such technologies helps monitor fuel efficiency, driving patterns, and total mileage, yielding significant cost savings. This data is particularly crucial for business tax reporting and analysis. The detailed records can assist in tracking the efficiency of the transportation system, providing valuable insights that can optimize routing and potentially reduce overall costs.

Maintaining Accurate Records

Comprehensive Logbook Entries

Maintaining accurate logbook records is paramount for ensuring proper tax reporting. Each entry must include the date, time, starting and ending locations, purpose of the trip, and the total mileage. Additionally, documentation of any tolls, parking fees, or other vehicle-related expenses is essential. Keeping detailed records helps in future analysis and simplifies tax preparation.

Supporting Documents: Receipts and Invoices

Supporting documentation, such as receipts and invoices, is vital for verifying vehicle-related expenses. These documents can substantiate the cost of repairs, maintenance, insurance, and other expenditures. By organizing these documents chronologically alongside the logbook entries, you create a comprehensive record of vehicle expenses, ensuring the accuracy and legitimacy of your tax claims.

Example Scenario

If a company claims depreciation on their vehicle, maintaining detailed records of repairs and maintenance, as well as receipts, is essential for supporting their claims. These receipts provide evidence of expenditures and allow for accurate depreciation calculations in tax reports. The thorough documentation ensures that the tax authority has sufficient information to review and approve the deductions.

Utilizing Technology for Efficiency

Mobile Apps and Software Solutions

Numerous mobile apps and software solutions simplify the process of tracking vehicle mileage and usage. These tools offer user-friendly interfaces for recording trip details, calculating mileage automatically, and even generating reports. These digital tools can help streamline the entire process, preventing errors and ensuring the accuracy of your records.

Integration with Accounting Software

For businesses, integrating mileage tracking software with accounting software can streamline the entire process. This integrated approach allows for automatic data transfer, minimizing manual effort and reducing the possibility of errors. By linking your vehicle tracking with your accounting system, you ensure efficient data management for easier tax season preparation.

Example Scenario

A small business owner who uses a mileage tracking app connected to their accounting software can automatically categorize vehicle expenses, generating detailed reports at the click of a button. This automation saves valuable time and effort, enabling them to focus on core business operations and ensuring accurate tax reporting.

Navigating Complex Situations

Multiple Vehicles and Drivers

Tracking vehicle usage for businesses with multiple vehicles and drivers requires a more sophisticated approach. Implementing a system that clearly differentiates between vehicles and drivers can prevent errors and ensure precise tracking of each vehicle’s usage. Using a centralized tracking system, including GPS, can be particularly beneficial.

Special Circumstances and Deductions

Various circumstances, such as vehicle usage for medical purposes or charitable work, may require additional documentation. Always consult with a tax professional or refer to relevant tax guidelines to ensure your approach aligns with specific rules and regulations.

Example Scenario

Consider a delivery service with several vehicles. A dedicated vehicle tracking software could assign mileage to each driver and vehicle, providing a clearer picture of the usage of each. This approach ensures accuracy and transparency in reporting vehicle expenses, safeguarding against potential disputes with the tax authority.

In summary, accurately tracking vehicle usage and mileage for tax purposes is crucial for avoiding penalties and ensuring compliance. By implementing a comprehensive system, from detailed logbooks to advanced GPS tracking, you can streamline this process and focus on maximizing your business deductions. Remember to consult with a tax professional for personalized advice, especially when dealing with complex situations or specific industry regulations. Take action now and ensure your vehicle expenses are handled correctly for a smoother tax season. Contact us today for a free consultation on how to streamline your vehicle tracking strategy.