Financing a used automobile is a significant financial decision, impacting your budget and future car ownership. Choosing the right loan can be tricky, and the interest rate plays a vital role. This comprehensive guide will walk you through various financing options for used cars, helping you understand interest rates and make informed decisions. We will delve into different loan types, explore the impact of credit scores, and analyze how interest rates vary. This article is structured to address all the critical facets of financing a used car, providing concrete examples and helpful tips.

Understanding Your Financing Options

Different Loan Types for Used Cars

Various loan types cater to different needs and financial situations when purchasing a used car. The most common loan type is the traditional auto loan, typically offered by banks and credit unions. These loans often require a certain credit score and may involve a fixed or variable interest rate. Alternatively, you can consider dealer financing, which involves working directly with the seller’s financial partners. Dealer financing may offer attractive terms but might have higher interest rates due to profit margins. Additionally, consider online lenders; many online lenders specialize in used car financing, providing quick approvals and potentially competitive rates, even for individuals with a less-than-perfect credit history. Ultimately, the best choice depends on your personal circumstances, credit history, and desired terms. For example, someone with a good credit score might benefit from a traditional auto loan with a lower interest rate. Someone with less-than-ideal credit might find a specialized online lender offers a viable alternative.

Interest Rates: A Key Factor in Your Decision

The Role of Credit Score in Interest Rates

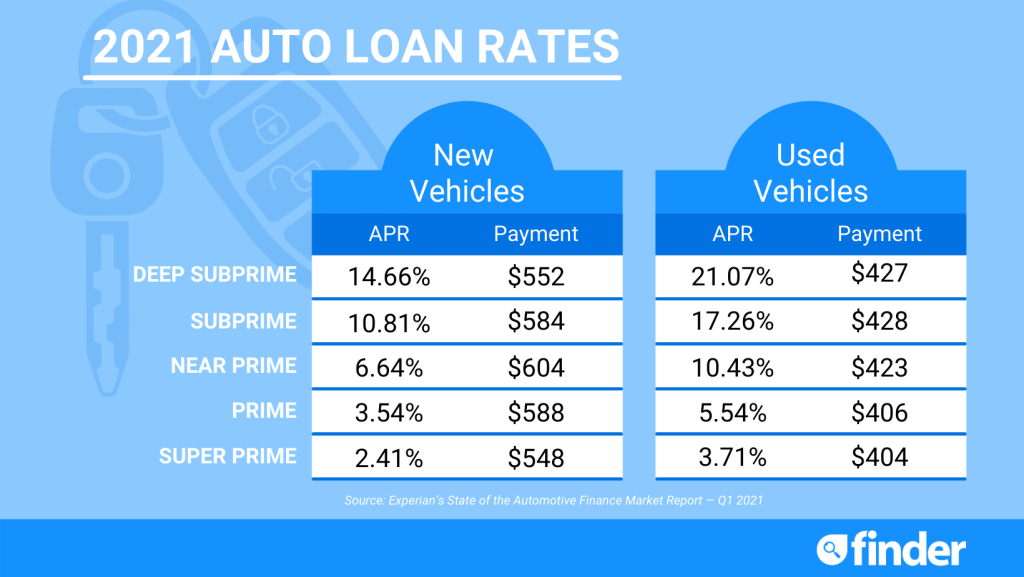

The interest rate you qualify for is a crucial factor in determining the overall cost of financing a used car. Your credit score significantly influences this rate. A higher credit score usually translates to a lower interest rate, as lenders perceive you as a lower-risk borrower. Conversely, lower credit scores might result in higher interest rates. This reflects the lender’s risk assessment, considering your potential to repay the loan. For example, a borrower with a credit score above 700 might qualify for a 4.5% interest rate while someone with a score below 600 might face a 12% or even higher interest rate. The difference in interest rates can significantly impact the total amount paid over the life of the loan, potentially leading to thousands of dollars in additional expenses.

Factors Affecting Loan Approval

Beyond Credit Score: Other Important Considerations

Beyond your credit score, various factors can impact the approval of your loan application for a used car. Your income and employment history are essential, reflecting your ability to consistently repay. Lenders scrutinize your income stability and debt-to-income ratio to assess your financial responsibility. The down payment you’re willing to make also influences your interest rate; a larger down payment often leads to better terms. For instance, a buyer who can put 20% down might qualify for a lower interest rate compared to someone putting just 10% down. Furthermore, the car’s value and condition play a role. Lenders evaluate the vehicle’s make, model, year, and condition to determine its worth. This ensures the loan amount aligns with the vehicle’s market value.

Comparing Loan Offers

Strategies for Securing the Best Deal

Comparing loan offers is vital to finding the best possible deal. Collect quotes from multiple lenders, both traditional and online lenders. Look at the interest rates, loan terms, and fees to identify the best fit for your situation. Don’t just consider the annual percentage rate (APR). Check for hidden fees like origination fees or prepayment penalties, which can substantially impact the overall cost of the loan. For example, comparing offers from two lenders might reveal significant differences in interest rates and fees. You could potentially save hundreds or even thousands of dollars by comparing and carefully scrutinizing the different loan offers.

Related Post : Used Car Buying Blunders: Avoiding Common Mistakes and Hidden Problems.

The Impact of Fees on Your Budget

Hidden Costs in Used Car Financing

It’s essential to be aware of the potential fees associated with financing a used car. These fees can include origination fees, prepayment penalties, or late payment charges. Origination fees are one-time charges that lenders collect upfront, whereas prepayment penalties may apply if you repay the loan early. Late payment penalties can accumulate substantial interest if not repaid on time. Understanding these fees is essential before committing to a loan to avoid unexpected financial burdens. For example, a lender might charge an origination fee of 1% of the loan amount, which can quickly add up depending on the loan amount.

Conclusion

FAQ

Frequently Asked Questions

Frequently Asked Questions Part 2

In conclusion, financing a used car involves careful consideration of various loan options and interest rates. Understanding the nuances of different financing methods, comparing interest rates, and checking for hidden fees are crucial steps in securing the best possible deal. This article has provided a comprehensive overview of financing a used automobile, and by taking the necessary steps outlined, you can confidently navigate the process and acquire a reliable vehicle. Now, take the next step, compare loan offers from multiple lenders and find the option best suited to your financial situation.